Managing your finances can feel overwhelming, but using a budgeting app can simplify the process. These apps help you track your income, expenses, and savings goals, giving you a clearer picture of your financial health. Here’s how to get started with a budgeting app:

1. Choose the Right App for Your Needs

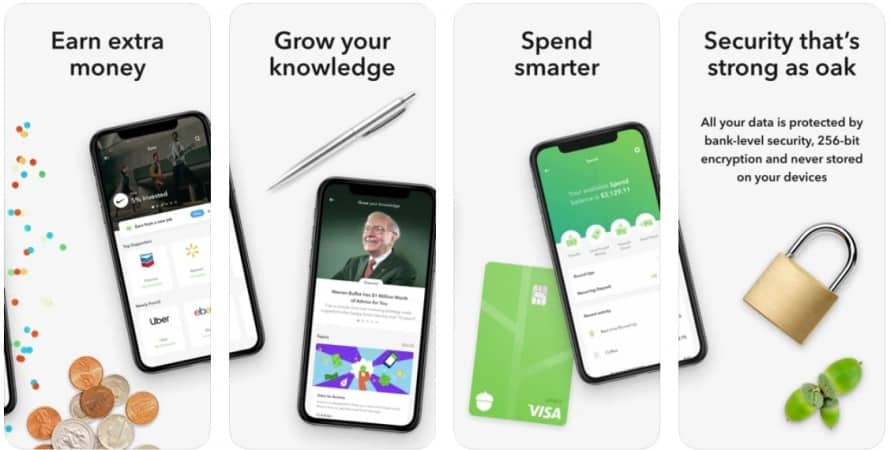

There are many budgeting apps available, each with different features. Some focus on expense tracking, while others help you set savings goals. Choose one that aligns with your financial priorities.

2. Connect Your Accounts

Most budgeting apps allow you to link your bank accounts, credit cards, and loans. This automatically updates your transactions, so you don’t have to manually input data.

3. Set Up Categories for Your Expenses

Once your accounts are linked, categorize your spending (e.g., groceries, utilities, entertainment). This helps you track where your money is going and identify areas to cut back.

4. Set a Budget and Stick to It

Create a budget based on your income and goals. Allocate specific amounts to each category and make adjustments as necessary to stay on track.

5. Monitor Your Progress

Review your spending regularly to see if you’re staying within your budget. Many apps send notifications to remind you when you’re approaching a spending limit.

🌱 Final Thoughts

A budgeting app can be a powerful tool for financial management. It keeps you organized, helps you track your goals, and can prevent overspending. By staying consistent with your budget, you can take control of your finances and work toward a more secure future.